Welcome Trendy Traders!

How was your first week of 2023?

The markets were true to form and tested the patience of traders who were eager to start banking profits from the opening bell of the short week. It was choppy ahead of econ events but ultimately Trendy levels prevailed!

If you’re not a subscriber to my Stubstack you can watch last week’s BMA here.

We had an amazing week in the room and our synergy was strong. I’m happy a good majority of my members shared their goals and strategies for the year ahead. Make sure you write yours down somewhere! We have a community journal where members share what worked and what didn't. It’s important to document your journey via pen and paper or digitally, whatever works for you.

Every trade is a learning opportunity!

I stayed true to my top resolution and kept the same allocation for every trade. If you haven’t considered allocation as part of your trade plan here’s a free handy calculator you can use.

I’m constantly updating my Youtube with educational material and I’m also available on Twitter if you have questions.

Neutral Strategy Review

How’d you like the action in the channel?

It was painstaking on the five-minute chart at the beginning of the week but as things shook out with econ data it was apparent bigger moves were due up to bat.

Our downside T2 target on SPY was tagged into the Tuesday session before bouncing into the neutral zone where it happily chopped up participants. It was a tough go for a lot of traders but if you remained patient there was plenty of playfield for profits.

In conjunction with the neutral strategy, we utilized the PMZ to guide us intraday. Committing to candles (waiting for them to close on your given TF before executing) is imperative in these market conditions and if you try to front run 50/50 odds aren’t favorable.

I shared these /ES levels with the room on Friday. If you’re a paid subscriber I’ll be sending out updated levels as needed starting this week so make sure to turn on notifications. If you don’t have the Substack app I suggest you get it!

On the 4-hr SPY chart there was something brewing come Friday as a series of inside candles plus a hold of downside T2 support and lower monthly edge (purple line) shifted our sentiment to the bullish side intraday.

So we bought puts at the lows… Just seeing if you’re awake =).

That SPY support launched a powerful move to the upside before and broke the top of the channel. I gave this box to you in the BMA… Crazy isn’t it?

I’m looking forward to sharing this week’s plan below!

For $10/month, you’ll receive trading plans every week along with additional updates. You can save if you buy an annual subscription. These prices will be going up in 2023. I’m also offering a Founder’s Package which includes a year of Trendy Trading Pro for a 25% discount. This is a taste of what members get.

A reminder, you can find my public back issues on my old platform.

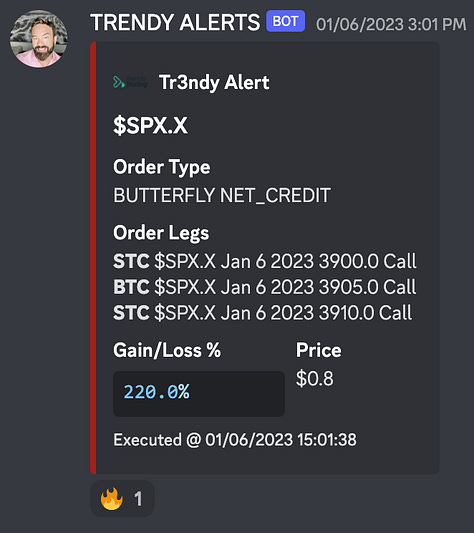

Some trade highlights from the week. Remember all trades are real-time direct from TD Ameritrade via API! (For Substack brevity I’m showing closing orders[STC]. When we open a position it’s BTO):

SPY January 8-13, 2022

The economic calendar this week is loaded. Bostic gives remarks Monday with Jerome speaking from IKEA on Tuesday before a news-heavy Thursday (core CPI, job claims). Friday we have BANKS reporting (BAC, JPM, WFC).

Let’s take a quick peek at SPY from 30,000 ft before we focus on this week’s plan. Charts for yearly, quarterly, and monthly below. What do you see in the Qtr?

Keep reading with a 7-day free trial

Subscribe to Weekly Trading Plan to keep reading this post and get 7 days of free access to the full post archives.